“It was the best of times, it was the worst of times …” The first sentence in Charles Dickens’ A Tale of Two Cities is how many small business and privately held company owners are feeling right now. After a decade of low interest rates and generally good business conditions, we are now entering a period where the economic and business environment is much more challenging. I don’t need to get into the details of the long period of the pandemic, supply chain problems, inflation, and higher interest rates in this article. You all know very well how these factors have impacted you and your businesses.

For many business owners, it is estimated that as much as 80 to 90 percent of their net worth is tied up in the value of their company. So now is the time for those owners to get organized and begin the planning process necessary to grow their companies, increase the value of the business and make the final push for an exit at the highest possible price. Typically, this process will take about three to five years, so you need to get started sooner rather than later.

To this point, I have compiled a checklist of what you should be doing right now to make sure you will be in a position of strength as we enter more challenging times.

Business Valuation

This should be done by a third party company or a trusted advisor. The business valuation will give you a realistic picture of the current status of your company and act as a starting point to fill the gap between the current valuation and what you would like to achieve in a potential sale. This should be done as soon as possible and updated annually.

Succession Plan

Make sure you have a written and documented succession plan on file. This protects you and your family prior to any completed exit event. It also spells out who would fill your role if something unfortunate happens (usually death or disability).

Personal Assessment

This step ideally would involve your family and answer questions about your needs, goals and what a retirement life would look like. Most owners have spent an enormous amount of time running their business and have not taken the time to envision what they would like to accomplish after an exit.

Financial Assessment

This involves finding out your net worth, income sources in retirement and what amount you will need to get in the sale of a business to make your retirement secure and comfortable.

Business Assessment

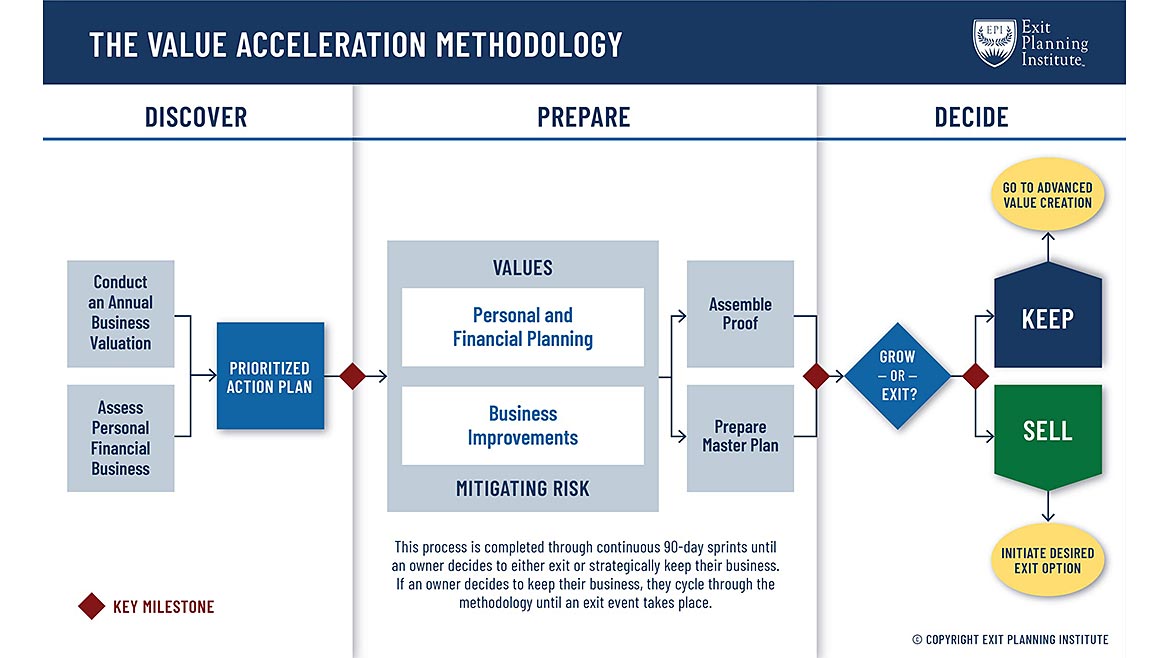

This involves looking at the readiness of your business for a future sale and the attractiveness of your business to a potential acquirer. The Exit Planning Institute has a survey for both of these assessments and recommends that you work with a Certified Exit Planning Advisor to complete them for the best results.

Start building a team of trusted advisors to assist you with this process. This group of advisors should include your financial advisor, CPA, attorney, and a banker. These professionals will most likely be your core group and they can bring in other individuals to assist, where and when needed.

There is no question that every owner will eventually exit his or her business at some point. The main concern should be … will it be on your terms and at the business’ highest valuation?

Report Abusive Comment